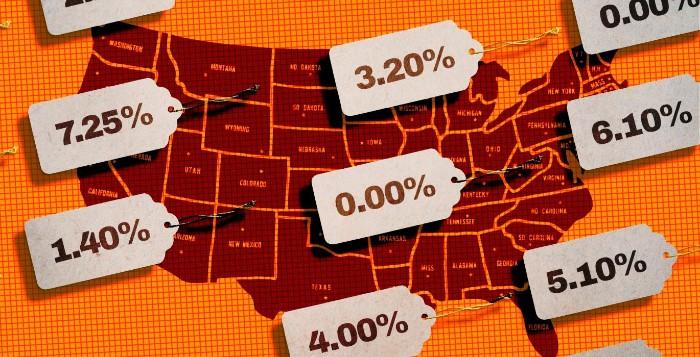

Americans understand that taxes are an inevitable part of life, and while they may complain about how much they have to pay, different states levy different sales tax rates.

It's becoming increasingly important for consumers to be aware of the range of taxes nationwide to avoid getting caught off guard by unexpected fees at the checkout counter.

So, let's dive into our research and explore where shoppers encounter the highest and lowest sales taxes in America!

Overview of Sales Tax in the U.S

State and municipal governments in the United States levy sales tax, a type of consumption tax. At the point of sale, it is charged on the sale of specific goods and services. States and municipalities have different tax rates and rules, creating a complicated and varied sales tax environment across the nation.

In the U.S., sales tax is typically not imposed at the federal level but at the state and local levels. Each state has the authority to set its own sales tax rate, varying from 0% to over 10%. Local governments, such as counties and cities, may also impose their own sales tax on top of the state tax, resulting in different rates within a state.

The items subject to sales tax can also vary by state. While most states tax the sale of tangible goods, such as clothing, electronics, and furniture, the taxation of services and groceries can differ. Some states exempt certain items, like groceries or prescription drugs, from sales tax, while others include them.

States With the Highest Sales Tax

Louisiana

One of the highest sales tax rates in the country is in Louisiana, where state and local authorities combined rates can reach up to 10%.

Tennessee

Tennessee also has one of the highest sales tax rates at 9.5%, including state, local, and restaurant meal taxes.

Alabama

The combined state and average local rate in Alabama is 9.1%.

Arkansas

The sales tax rate in Arkansas is slightly lower at 9%, including state, county, city, transit authority, and special district levies.

Washington

Washington's combined sales tax rate is 6.8% on most goods sold within the state as of 2020.

Oklahoma

The combined rate in Oklahoma is higher at 8.9%, including state and local taxes.

California

In California, the combined sales tax rate is 7.5%. Local taxes can raise this rate to 10%.

States with the Lowest Sales Tax Rates

Oregon

Oregon has one of the lowest overall sales tax rates at 0%.

Alaska

Alaska also has a low sales tax rate of 1.76%.

Delaware

Delaware's overall sales tax rate is 0%, with limited exceptions such as hotel occupancy taxes.

New Hampshire

In New Hampshire, the state does not impose sales or use taxes on retail sales.

Montana

The state of Montana has a low sales tax rate of 6%.

Hawaii

In Hawaii, the combined state and county sales tax rate is 4.4%, one of the lowest in the country.

Wyoming

The overall sales tax rate in Wyoming is 5%. Local governments are prohibited from imposing sales taxes.

What the experts say

Sales tax is a significant source of revenue for state and local governments in the United States. Different states have different policies regarding sales tax, resulting in varying rates across the country.

Understanding the nuances of sales tax is essential for businesses and consumers alike. Sales tax rates can vary significantly across different states and localities in the United States, leading to varying tax burdens for consumers.

Several experts and organizations have analyzed and provided insights into the states with the highest and lowest sales tax rates.

Here's what they have to say:

Tax Foundation

The Tax Foundation, a nonpartisan tax research organization, has consistently provided analysis of state and local tax policies. They note that states like California, Indiana, Mississippi, Rhode Island, and Tennessee tend to have higher sales tax rates than others.

Kiplinger

Kiplinger, a personal finance and business forecasting company, has examined sales tax rates nationwide. Their analysis confirms that states such as California, Mississippi, and Tennessee have higher sales tax rates.

TaxJar

TaxJar, a company specializing in sales tax automation, has compiled data on sales tax rates. They also highlight states like California, Indiana, Mississippi, and Tennessee having higher sales tax rates.

These experts collectively acknowledge that certain states, such as California, Indiana, Mississippi, and Tennessee, consistently rank among the states with higher sales tax rates.

It is important to note that sales tax rates can change over time, so it is recommended to refer to up-to-date and official sources or consult local tax authorities for the most current information.

The Impact of Sales Tax on Consumers

Sales tax has a direct impact on consumers and can influence their buying decisions in several ways:

Price Sensitivity

Sales tax increases the final price of a product or service, making it more expensive for consumers. This heightened price sensitivity can lead consumers to compare prices more carefully, seek lower-priced alternatives, or wait for sales and discounts to offset the tax burden.

Consumer Behavior

Sales tax can shape consumer behavior by affecting purchasing patterns. Consumers may buy exempt items and necessities or have lower tax rates while delaying or reducing non-essential purchases subject to higher taxes. This behavior can impact various sectors, such as retail, dining, and luxury goods.

Cross-Border Shopping

In areas near state borders or countries with lower tax rates, consumers may travel or shop online in locations with lower or no sales tax to save money. This phenomenon, known as cross-border shopping, can have economic implications for businesses and governments, particularly in regions with significant tax differentials.

Online Shopping

The rise of e-commerce has made it easier for consumers to compare prices across different jurisdictions and find lower tax rates or tax-free purchases. This can influence consumers to shift their buying habits towards online retailers or platforms that offer tax advantages, impacting traditional brick-and-mortar businesses.

FAQs

What is the average sales tax in the United States?

The average sales tax in the United States is 7.12%. However, this number can vary greatly depending on which state and local governments are imposing taxes on your purchase.

How do sales taxes work?

Sales taxes are calculated based on the purchase price of certain goods or services. The sales tax rate can vary depending on the location, purchased product type, and even how you pay for the item. The seller typically collects sales taxes from the buyer at the time of sale and then remitted to state and local governments.

What items are subject to sales tax?

Items that are subject to sales tax vary from one state to another. Generally, tangible items like clothing, electronics, and furniture are taxable, while services like haircuts or professional advice may not.

Conclusion

Sales taxes can greatly impact our lives, our budgets, and the communities we live in. While some of us are fortunate enough to live in states with relatively low sales taxes, it's also important to recognize that others are not as fortunate.

By understanding more about sales tax regulations across the country and how they affect citizens from coast to coast, we can better understand the tangible impact these rules have on all of us.

So if you're looking for the nation's highest or lowest sales tax rates, here's where people pay America's highest (and lowest) sales tax.