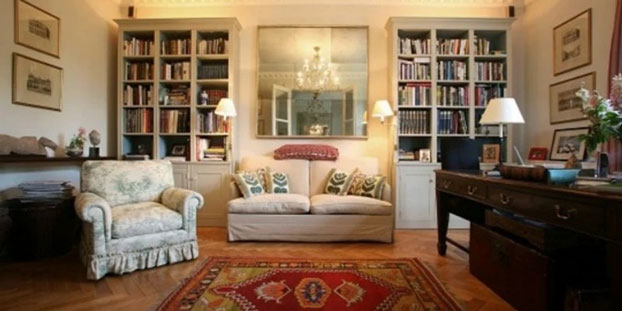

If your belongings are damaged, stolen, or lost, contents insurance will pay to replace or repair them. Everything you own that you would like to take with you when you move houses, such as your furniture, kitchen appliances, drapes, bedding, clothing, TV, computer equipment, and jewelry. It's crucial that you accurately estimate the sum covered for your belongings, as this is the most money your insurer will pay out in case of a claim. Insuring your belongings for their replacement cost rather than their present value is a good idea. Always check your content, especially after significant purchases, holidays, and other special occasions. It is essential to verify that the limit of your contents policy is adequate to cover your valuables.

How Do You Define Content Insurance?

Protecting your home, belongings, and yourself from liability claims are the three main focuses of a homeowners insurance policy. Personal property insurance, often known as home contents insurance, safeguards your possessions against loss or damage caused by certain risks. Any potential threat to your home and controls should be taken seriously. Theft, fire, lightning, hail, and vandalism are all examples of typical insurance claims. Standard coverage for your belongings may have restrictions depending on your policy and insurance provider. Typically, insurers will cover up to $100,000 in contents. Get an endorsement if you think you might need it.

How Much Insurance Coverage For My Home's Contents Do I Need?

When determining compensation for damage covered by a homeowner's policy, the policy's "replacement cost" is often used. If your home and all of your possessions are destroyed, your insurance company will pay to have it rebuilt to its pre-loss condition using materials of equal or greater worth. Depreciation is factored into an item's actual cash value (ACV). If your leather sofa, which is five years old, were destroyed in a fire, the real cash worth would determine how much you would be compensated for its replacement. The difference between the replacement cost and the actual cash value is typically quite considerable. The standard for flood insurance is real cash value, although replacement cost coverage is available for an additional premium.

Why Should You Purchase Insurance For Your Home And Its Contents?

Is there enough money in the bank to cover the cost of completely rebuilding your home in a catastrophic event, such as a bushfire? You might be surprised to see how much your belongings are worth when added up. As a result, our homes are among the most valuable (and costly) possessions we might have, and it can be quite a financial burden to replace one. Because of this, home and belongings insurance is something you should think about. If your home and belongings are damaged or destroyed by an insured peril, you won't have to worry about how you'll pay to rebuild. If you have insurance, you may rest easy knowing that the company providing your coverage will share the financial burden of making repairs or rebuilding after a disaster.

Combined Coverage For Your Home And Its Contents

The best way to protect yourself from financial ruin in a burglary, a natural disaster, or a fire is to have insurance coverage for your dwelling and your belongings. You can accomplish this goal by getting homeowner's insurance and a separate contents policy from the same firm; alternatively, you can shop around and buy policies from other companies. You can be eligible for a discount if you purchase multiple plans from the same provider simultaneously.

Conclusion

If your home's contents are stolen, damaged in a fire, or otherwise lost due to an insured event, contents insurance will assist you in replacing those items. The home's contents, including the furniture and equipment, can be protected by a policy's personal property coverage. Everything you possess and store in your house is the "contents" of your home. Examples of personal property include furniture, vehicles, and jewellery. Ensure you update your insurance policy when anything has changed since you last renewed it. Brand new features, such as a specialized container for fragile objects, can be integrated. The best way to ensure you are paying the least for insurance is to compare quotes from multiple providers. Remember that maintaining your current insurance could lead to a rate hike.